Press Release

Global Solar Council: Africa's Solar Market set to surge 42% in 2025 - But Finance Bottlenecks Threaten Growth

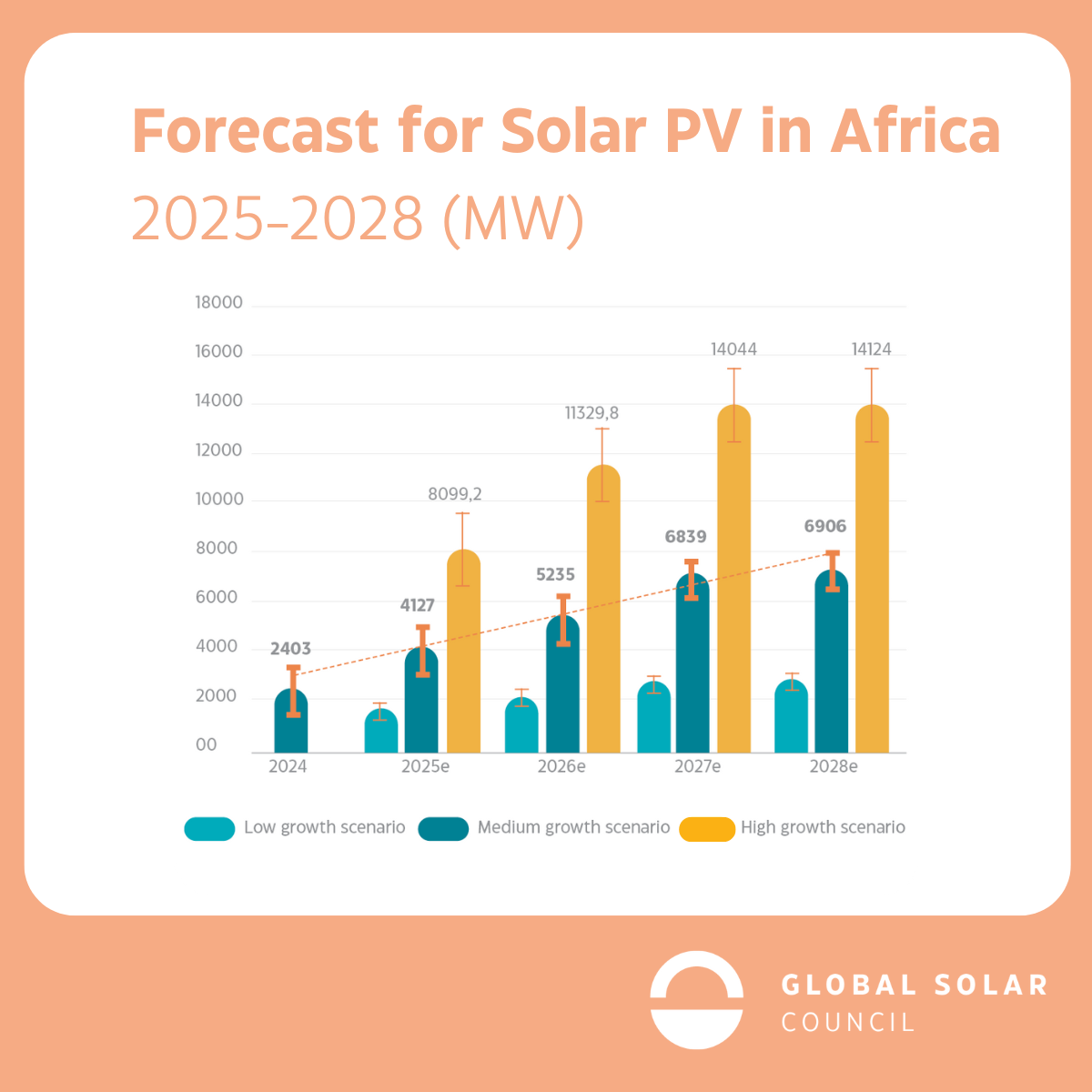

New GSC report finds that 23 GW of new solar PV capacity is projected to be installed over next four years in Africa. But access to low-cost finance remains a key barrier for African countries to realize this potential - removing this barrier will be critical to meet global climate and sustainable development targets.

Nairobi, 12 March 2025 – Africa's solar sector is gaining momentum, with annual installations set to grow 42% in 2025 according to a new report published today by the Global Solar Council (GSC) in partnership with the Rocky Mountain Institute (RMI) and supported by GET.invest. The Africa Market Outlook for Solar PV 2025-2028 reveals the continent is on the verge of a solar breakthrough – but is held back by high capital costs and insufficient financing.

Africa is home to 60% of the best solar resources globally, yet only 3% of its electricity generation was met with solar PV in 2023. The new report provides new analysis on current market status, market outlook and opportunities to tap into this vast solar potential across the continent.

“Africa’s solar potential is undeniable, and we’re seeing more African countries embrace solar than ever before to power jobs, industries, economic growth, hospitals, schools, and more in both rural communities and urban centers alike. But we are still only scratching the surface,” said Sonia Dunlop, CEO of GSC. “Realizing Africa’s solar potential is mission critical to meet the global target of tripling renewables by 2030, avoiding the worst impacts of climate change, and ensuring energy access and economic opportunity for all.”

A Market on the Rise

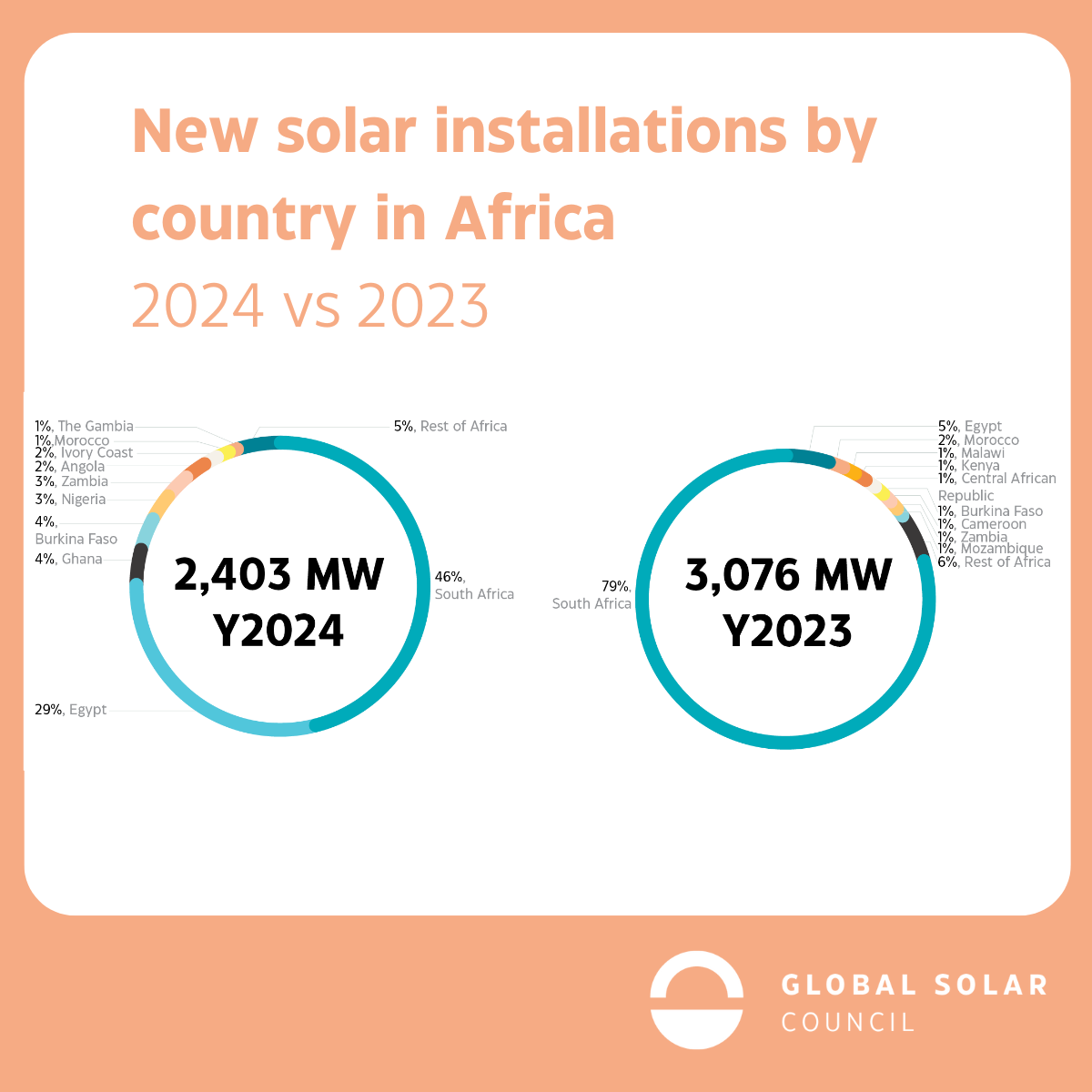

In 2024, Africa installed 2,402 MW of new solar capacity. While this marks a decrease from 3,076 MW in 2023, the shift reflects a broader regional market transformation, with emerging markets displaying remarkable growth.

- South Africa (1,108 MW) remains the leader, but installations fell 33% compared to 2023, returning to more typical levels after last year’s record-breaking boom.

- Egypt surged to second place, adding 700 MW in 2024, largely from two massive utility-scale projects.

- West Africa saw rapid growth, with Ghana (94 MW), Burkina Faso (87 MW), and Nigeria (73 MW) emerging as key players. Ghana nearly quadrupled its installations, while Burkina Faso’s market grew 129% year-on-year.

- Zambia (69 MW) doubled its solar capacity, a critical shift as droughts disrupt the country’s hydropower supply.

- Angola, Ivory Coast, and Gambia all made the top 10 for the first time, marking a clear expansion beyond the region’s traditional solar powerhouses.

Looking forward to this year, this market diversification will continue with at least 18 countries projected to install over 100 MW of new solar capacity – up from just two in 2024.

By 2028, Africa is expected to install an additional 23 GW of solar—more than doubling its current capacity. However, this growth depends on securing affordable finance and stronger policy frameworks to attract investors.

Finance: The Make-or-Break Factor for Africa’s Solar Future

Africa’s solar expansion is being held back by capital costs that are 3 to 7 times higher than in developed countries. While clean energy investment doubled to $40 billion in 2024, Africa still accounts for just 3% of global energy investment—far from the $200 billion per year needed to achieve energy access and climate goals.

“There is no shortage of excellent solar resources and political ambition in Africa — only a shortage of affordable capital” said Léo Echard, Policy Officer at GSC and Lead Author on the report. “Many projects are struggling to secure financing because of high interest rates, currency risks, and lack of guarantees. If we can reduce the cost of capital, Africa could become one of the fastest-growing solar markets in the world.”

The report outlines a clear roadmap to accelerate solar deployment across Africa, including:

Expanding innovative financing mechanisms, de-risking instruments, and private sector investment to lower the cost of capital for solar PV

Strengthening policy and regulatory frameworks to attract private sector investment

Boosting domestic solar manufacturing and skills to enhance job creation and energy independence.

Reinforcing grid infrastructure and flexibility, interconnectivity and off-grid solutions to ensure energy access to all.

Catalyzing demand through new industries like green hydrogen and e-mobility to lower costs of solar

About the Global Solar Council

The Global Solar Council (GSC) is the united voice of the solar industry worldwide. As a non-profit trade body, our vision is to create a fair and sustainable world with solar at the heart of a new energy economy. Driven by our passion for a cleaner, more just world, we work as a community to ensure everyone’s voices are heard, advocating for swift progress to be made in the battle for the climate. We advise governments on the pressing issues central to the solar transition, including finance, grids, skills, sustainability and supply chains.

Get involved at www.globalsolarcouncil.org and follow us on LinkedIn, WeChat, and X.

Rocky Mountain Institute

Founded in 1982 as Rocky Mountain Institute, RMI is an independent, nonpartisan, nonprofit that transforms global energy systems through market-driven solutions to secure a clean, prosperous, zero-carbon future for all. We work in the world’s most critical geographies and engage businesses, policymakers, communities, and nongovernmental organizations to identify and scale energy system interventions that will cut greenhouse gas emissions at least 50 percent by 2030. Find out more at www.rmi.org.

About GET.invest

GET.invest is a European programme that mobilises investment in renewable energy, co-funded by the European Union, Germany, Norway, the Netherlands, Sweden and Austria. Services are primarily aimed at private sector companies, project developers and financiers in sustainable energy markets in partners countries. They comprise tailored access-to-finance advisory for clean energy developers, a funding database, market information, and financial sector support to increase local currency financing. Find out more at www.get-invest.eu.

![Global Solar Council [logo]](/static/images/gsc-logo-horizontal.svg)