Africa Market Outlook for Solar PV 2025-2028

Africa holds vast solar potential, with 60% of the world's best solar resources, yet solar PV currently accounts for only 3% of the continent’s electricity generation. As global efforts intensify to triple renewable energy capacity by 2030, Africa’s role in achieving this target is more critical than ever.

The Africa Market Outlook for Solar PV 2025-2028 provides an in-depth analysis of the region’s solar growth, investment landscape, and policy frameworks. The report examines key markets, highlights emerging opportunities, and outlines the financial and regulatory measures necessary to scale up deployment.

With contributions from industry experts and stakeholders, the report explores the challenges of financing solar projects, grid integration, and the role of both utility-scale and off-grid solutions in driving energy access. It also presents market forecasts, investment trends, and policy recommendations to support Africa’s transition to a clean energy future.

Published in partnership with RMI and supported by GET.invest, this report serves as a key reference for policymakers, investors, and industry professionals seeking insights into Africa’s evolving solar sector.

Key Takeaways from the Report

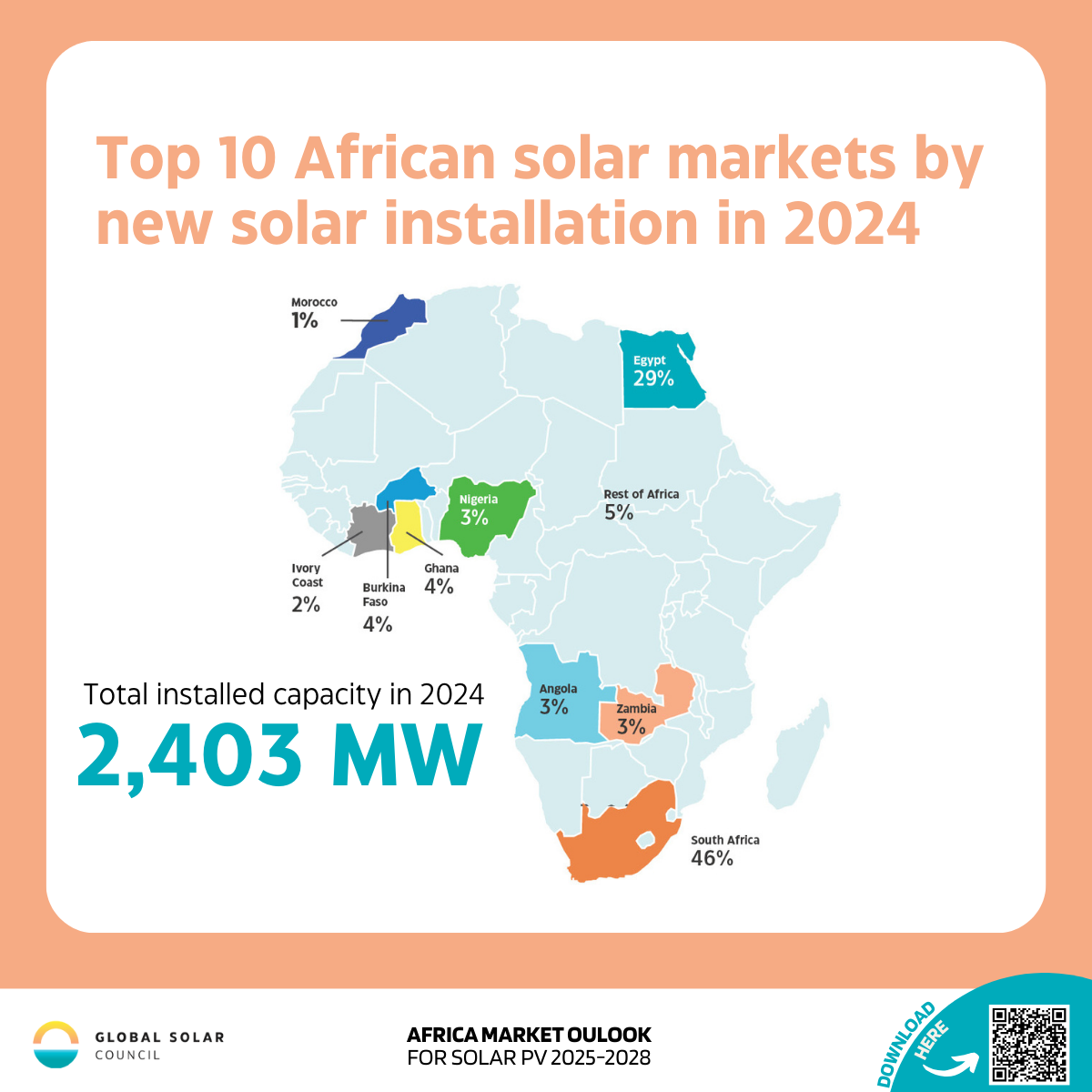

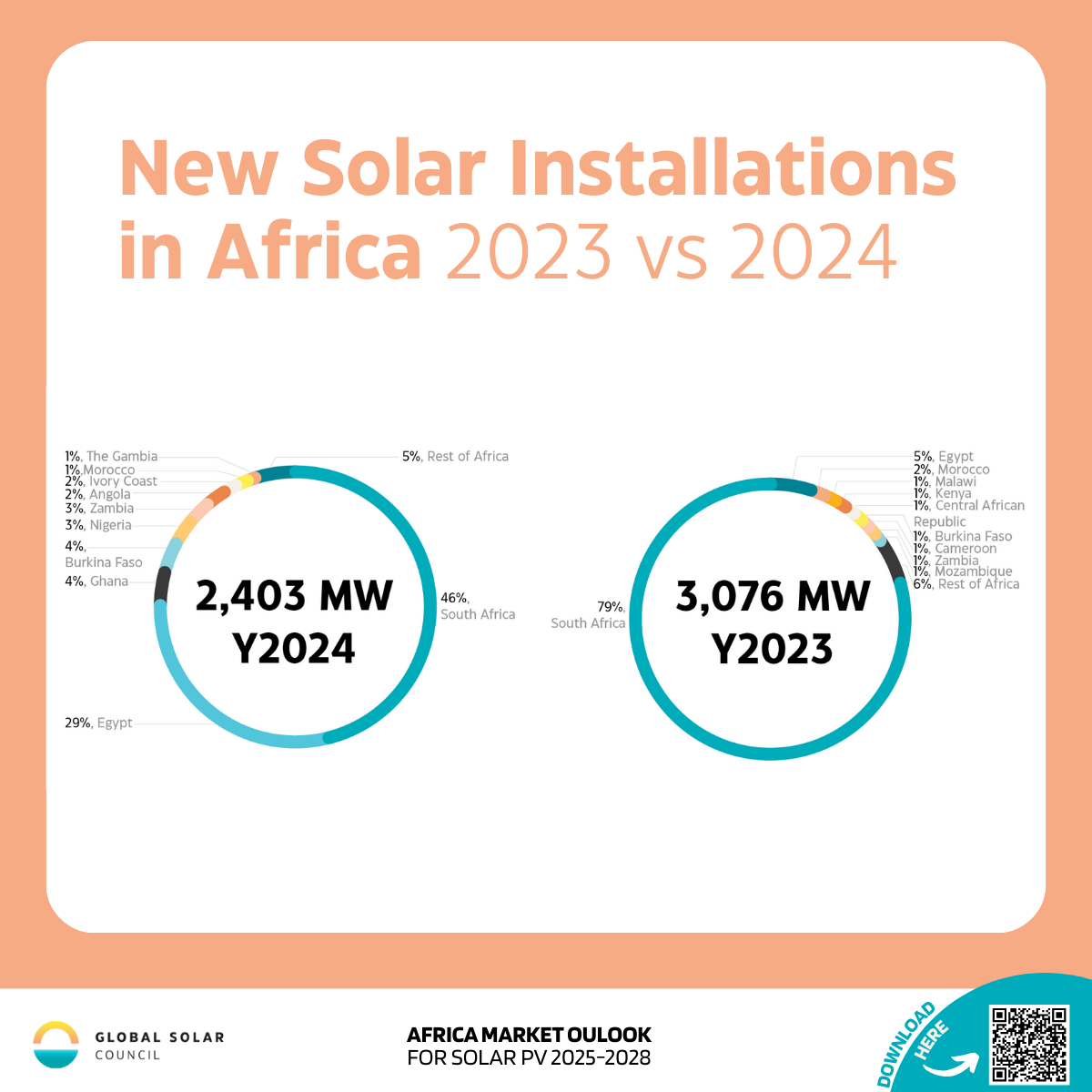

2.4 GW of new solar capacity was installed in Africa in 2024.

South Africa and Egypt continue to be leading the pack, but new emerging markets are stepping up. While this is a slight decrease from 2023, the shift reflects a broader regional market transformation.

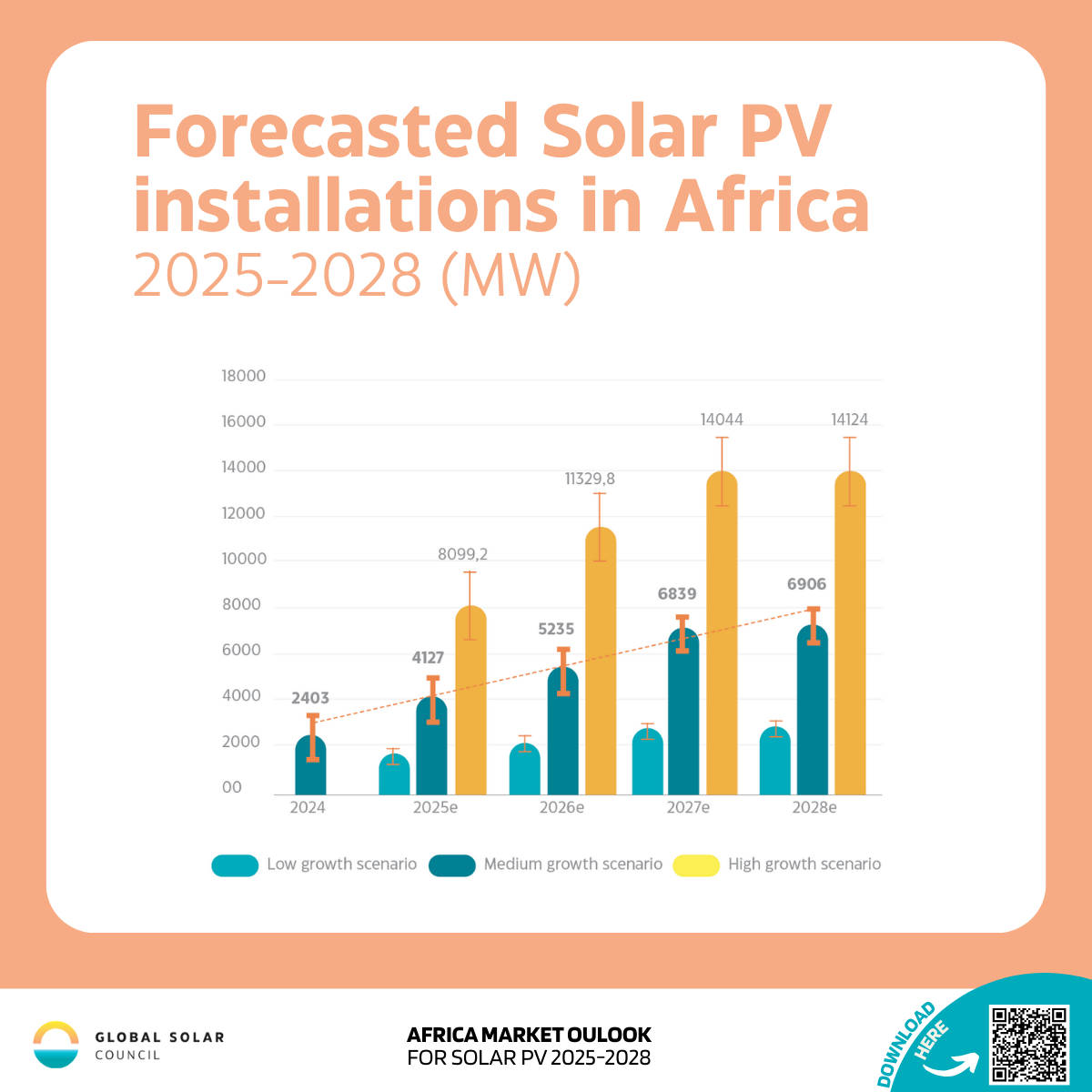

Africa's solar market is set to surge by 42% in 2025

By 2028, the continent is expected to install an additional 23 GW of solar - more than doubling its current capacity. However, this growth is still a fraction of the immense solar potential in Africa, and it is essential to tap into this resource to meet global climate goals and the tripling of renewables target.

Market diversification will boost the continent's solar capacity

In 2025, 18 African countries are expected to install at least 100 MW of new solar capacity - up from just two in 2024. This means more solar will be installed in more countries, boosting the regions overall solar market to lower costs, create new jobs, and spur industrial opportunities.

Scaling-up access to low-cost finance will be critical to tap into Africa's solar potential

Capital costs for solar are 3 to 7 times higher in Africa than in developed countries, and the continent only receives 3% of global energy investment - fare from the $200 billion per year needed to achieve energy access and climate goals. Reducing the cost of capital through innovative financing mechanisms, de-risking instruments and private sector investment will be critical.

Renewable hydrogen and e-mobility will drive solar growth

As a low-cost, flexible and localized energy source, solar will need to play an important role in powering the continent's growing electricity demand. With new electricity-intensive industries such as renewable hydrogen and e-mobility on the rise in Africa, the demand for solar will also rise.

![Global Solar Council [logo]](/static/images/gsc-logo-horizontal.svg)